Hyper-personalized customer experiences: Are you ready?

By Pedro Andrade

0 min read

Products and services are no longer a competitive factor to differentiate companies. The real battleground lies in how they engage with and treat their customers to stand out from competitors. For example, I walk into my favourite coffee shop on a busy Monday morning and hear: “Good morning, Pedro! The usual cappuccino with an extra shot?” I nod, appreciating the familiarity and efficiency. Moments later, my drink is ready without having to say a word. This seamless and delightful experience makes me feel valued and start my day with a positive vibe. One might argue that this level of personalized service is possible because I live in a small neighbourhood and the barista happens to be the owner. But meeting the unique needs and preferences of each customer to make them feel valued—by delivering a personalized service—isn’t a privilege of the neighbourhood coffee shop only, it’s also a priority for big companies, especially in the customer experience area.

We’ve been using technology such as data analytics to understand customer needs, omnichannel to deliver seamless experiences across multiple channels, and predictive analytics to address customer issues proactively and offer relevant products and services. However, these capabilities are still pretty much a one-size-fits-all that don’t take into account each individual customer. The rise of generative AI changes this by empowering businesses to transform customer service and take these capabilities to a new era of hyper-personalization.

Hyper-personalizing customer experiences.

Hyper-personalized customer service completely transforms the customer experience by tailoring every step of the customer journey to meet individual needs, preferences, and behavior of each customer. It dynamically adjusts the customer experience as it unfolds, enabling businesses to automatically classify and prioritize interactions based on a sophisticated understanding of their content. Capabilities such as leveraging customer data and interaction history, geographical context, and even their mood nuances empower dynamically crafted, tailored responses and recommendations. It’s not just about analyzing data anymore, but weaving it into a contextually relevant narrative that resonates on a deeply personal level, creating a real-time path that is appropriate for each stage of the customer journey, driving meaningful and engaging customer experiences.

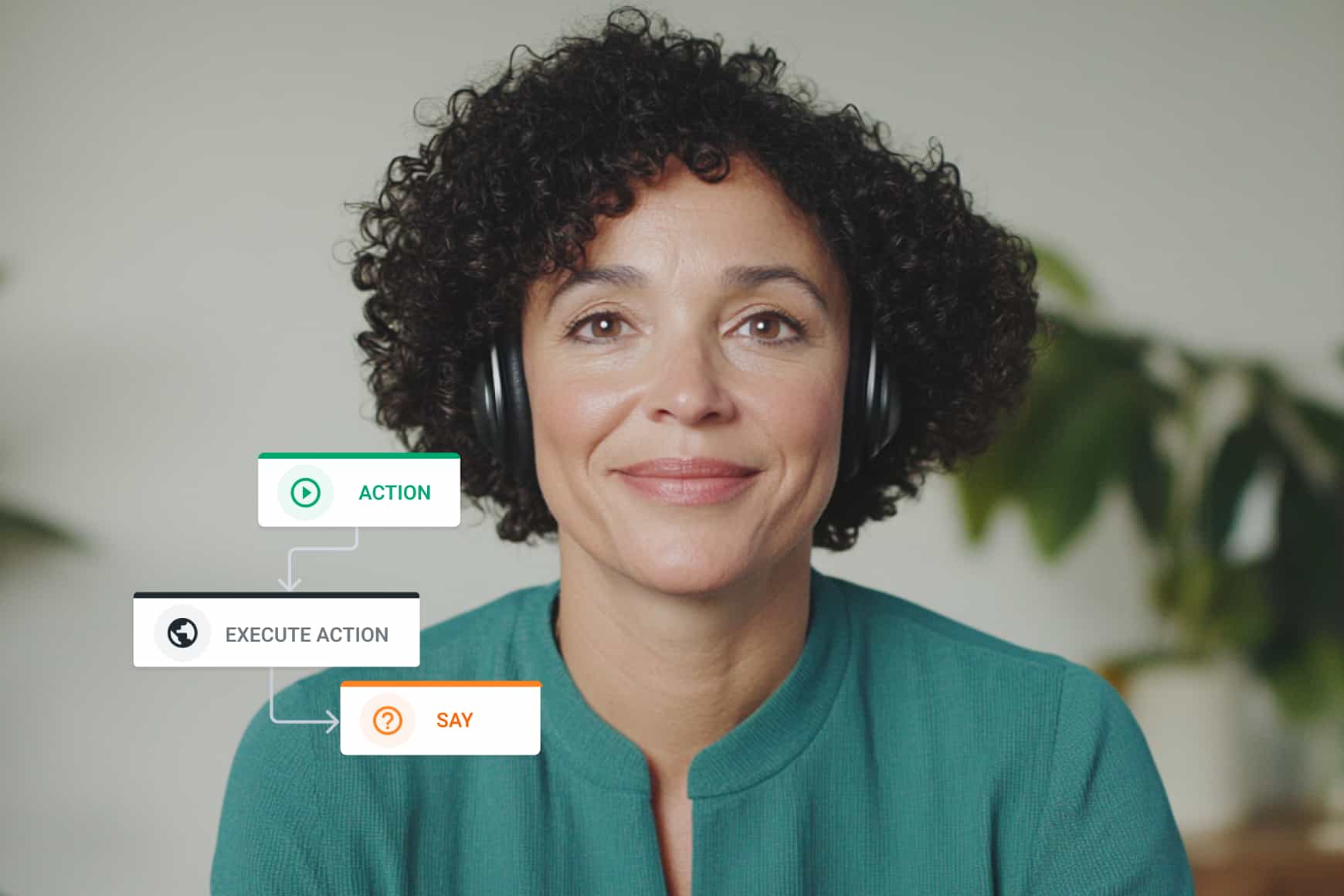

Hyper-personalization uses generative AI to understand customer data like never before to anticipate needs, deliver solutions, and mitigate risks. Large language models make content-based decisions to create hyper-personalized experiences driven by real-time understanding using key features such as:

Generative AI for routing customers.

Eliminate IVR prompts from customer service and allow customers to use their voice to express their issues instead of forcing them to navigate complex and frustrating IVR menus that often don’t have the right supporting option for the customer issue. Empowering customers to converse naturally and understanding their requests fosters more genuine and effortless interactions, improving the customer experience.

For example, a customer tries to pay with a credit card but the transaction is declined. Confused and concerned, the customer calls the bank. Instead of making them listen to a computerized voice string of support options where none of them addresses the issue, the customer can state in a natural conversation “My payment was declined, so I want to check my balance”.

Generative AI virtual agents.

Generative AI enables virtual agents to engage in natural and human-like conversations, personalizing recommendations. Checking the account balance is a straightforward task that can be handled by the bank’s virtual agent quickly with no need for the customer to wait in the queue or hold to speak to a human agent.

After hearing the account balance, and realizing there are funds, the customer asks why the credit card is declined. The virtual agent leverages customer data, such as transaction history, past interactions, and current balance but can’t pinpoint a reason for the insufficient balance and transfers the call to a human agent.

Generative AI agent assistants.

The human agent reviews the interaction data up until that moment, looks at the account, and identifies that a large pending transaction has temporarily reduced the available balance. While the human agent explains this to the customer, the agent assistant—a copilot that listens, guides, and assists agents during live customer interactions—pushes information about temporarily increasing the balance allowing the customer to make the payment.

This hybrid approach enhances the efficiency and effectiveness of human agents that receive the call with information about the customer’s issue and how to solve it. Taking into account the exact context of the interaction and dynamically changing the workflow delivers a seamless, hyper-personalized experience for each customer.

Understanding emotions to deliver hyper-personalized customer experiences.

Traditional sentiment analysis typically provides a very limited sentiment classification at the end of the interaction, categorizing it into simplistic labels such as positive, negative, and neutral. Generative AI-powered sentiment analysis picks up on emotions such as gratitude, anger, or frustration throughout the interaction. Real-time information about not only what customers are saying but also their emotional stage allows for the adjustment of the flow to change the mood of the customer immediately, as remediation is not possible after it ends.

Traditional machine learning sentiment models fail to understand context, leaving them vulnerable to words or expressions with ambiguous meanings. Also, they’re not able to detect sarcasm. However, with generative AI, we can analyze the complete context and recognize nuances, such as when someone sarcastically responds with “Great! That’s exactly what I need!” when learning the reason for the declined payment.

Gaining insights into customer emotions at the start of the interaction, observing how the mood evolves during the conversation, and identifying the factors influencing these changes helps to tailor personalized responses. This emotion-driven approach does more than solve problems—it builds trust, nurtures relationships, and creates loyal, brand advocates.

Remove the burden from customers and deliver seamless experiences by moving away from the old, impersonal and often frustrating loops of traditional customer service, and instead build engagement and lasting relationships effortlessly with generative AI. Rid your company of bad customer experiences by offering seamless, hyper-personalized customer journeys. See how!