Industries | FINANCIAL SERVICES

Smarter banking customer experience, powered by AI.

Unify omnichannel communications and enterprise data to automate workflows while elevating customer experience. Customer Experience Automation (CXA) powers agentic AI self-service, employee assistance, and multi-agent workflows across account servicing, lending, fraud mitigation, and more.

Reimagine the banking customer experience.

The CXA-powered contact center platform built for financial services comes with pre-built integrations to core systems and agentic AI trained on industry data. It unifies omnichannel engagement, intelligent routing, interaction analytics, and workflow automation — plus workforce, quality, and knowledge management — to streamline operations, empower employees, and elevate the customer experience.

CXA FOR FINANCIAL SERVICES

Better banking with transformational efficiency.

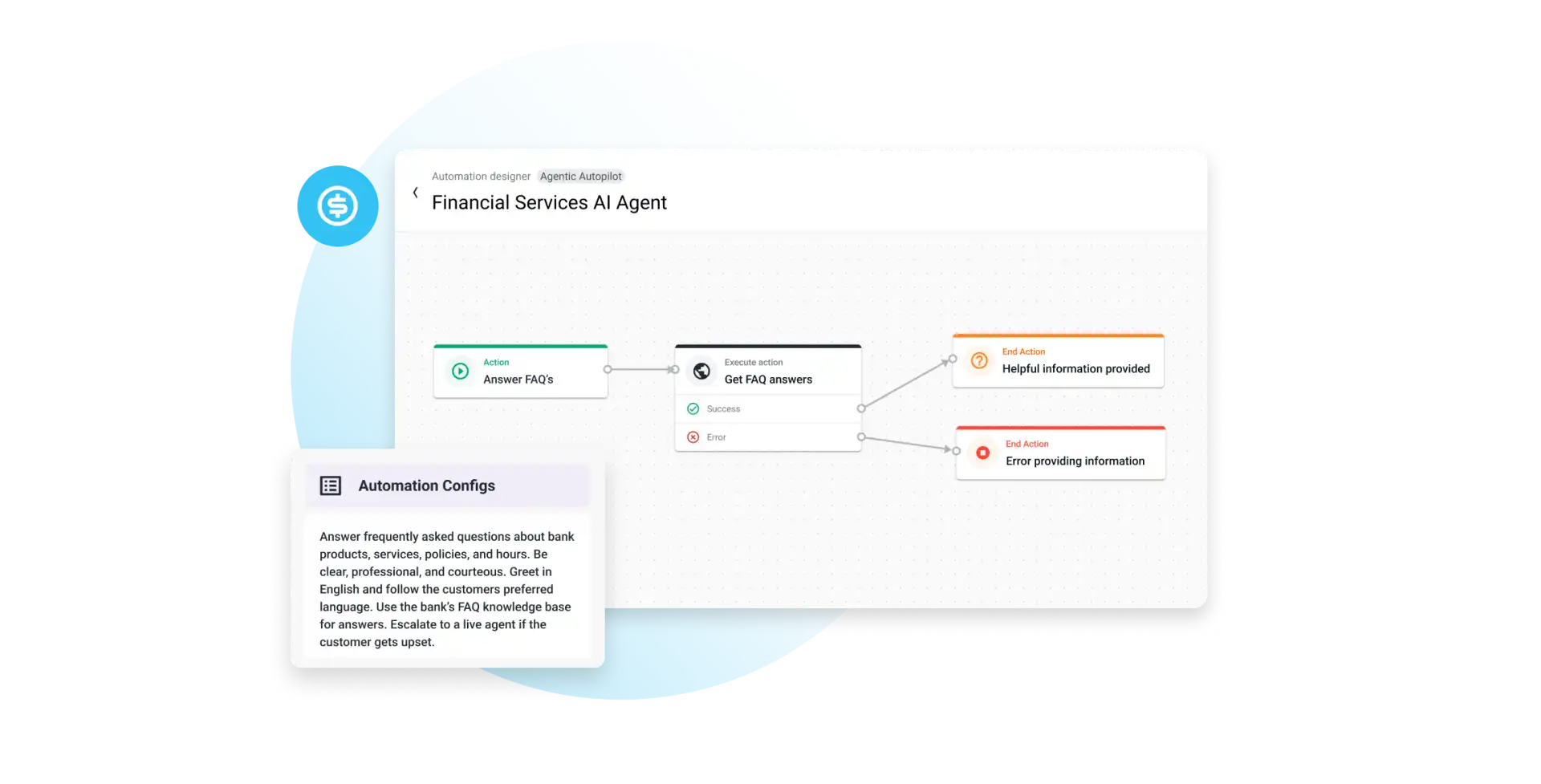

Talkdesk is pioneering a new era of financial services customer experience with Customer Experience Automation (CXA), a no-code AI platform built to automate and elevate modern customer journeys across account servicing, lending, collections, fraud mitigation and more. CXA replaces fragmented, manual workflows with autonomous, multi-agent AI orchestration that delivers intelligent, scalable, and secure customer service across the entire customer lifecycle.

Driving real results for leading financial institutions.

Built for banking, ready on day one.

With pre-trained AI models, pre-built core banking integrations, and workflows designed for lending, account servicing, and collections, bank contact center teams can start seeing results immediately—without the cost and complexity of customization.

AI-powered automation that increases efficiency, not risk.

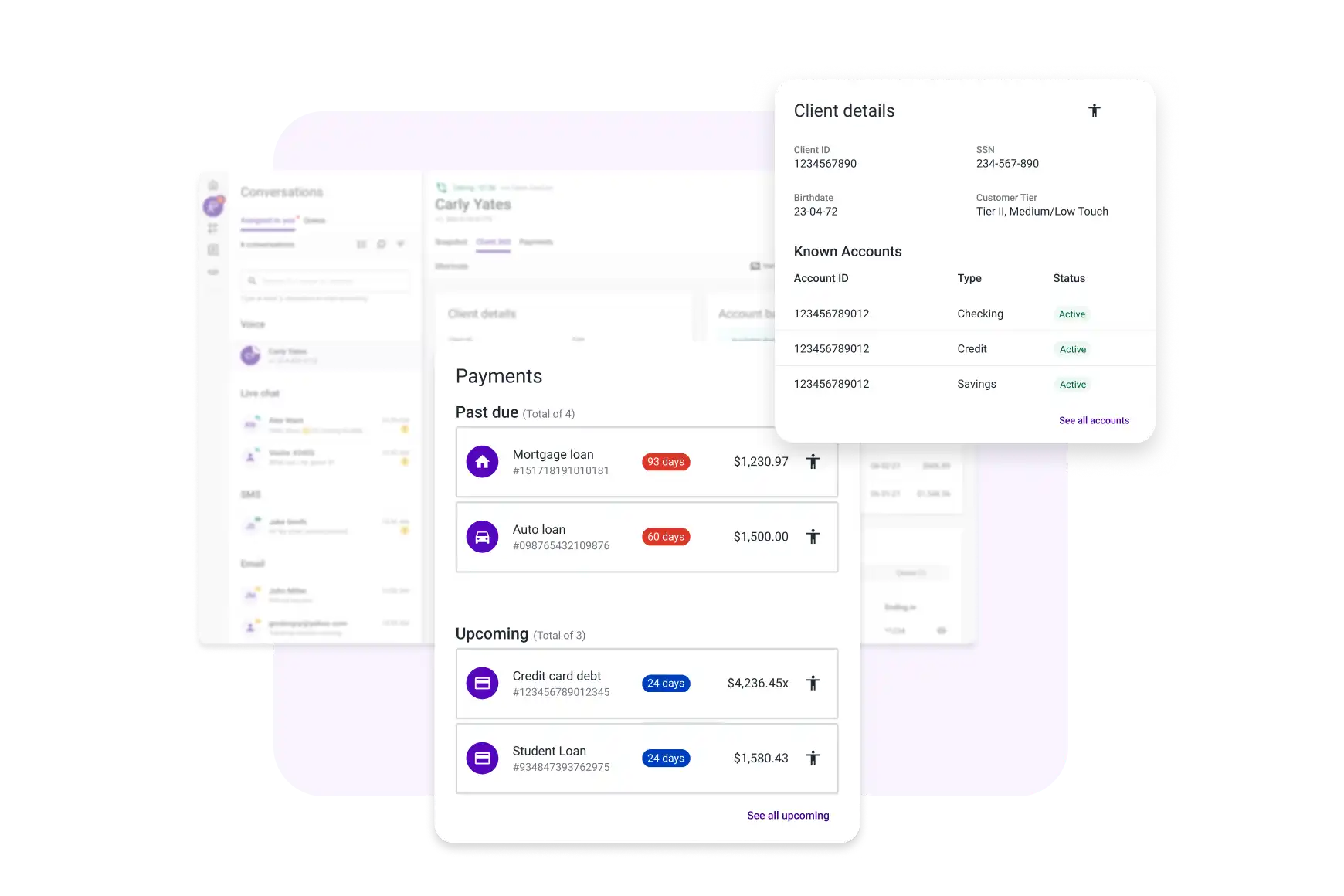

Automate account servicing, loan inquiries, payments, dispute resolution, and fraud detection with CXA multi-agent orchestration—freeing up employees to focus on high-value client interactions. With a unified view of client context, employees can work more efficiently, resolve inquiries faster, and deliver more personalized service.

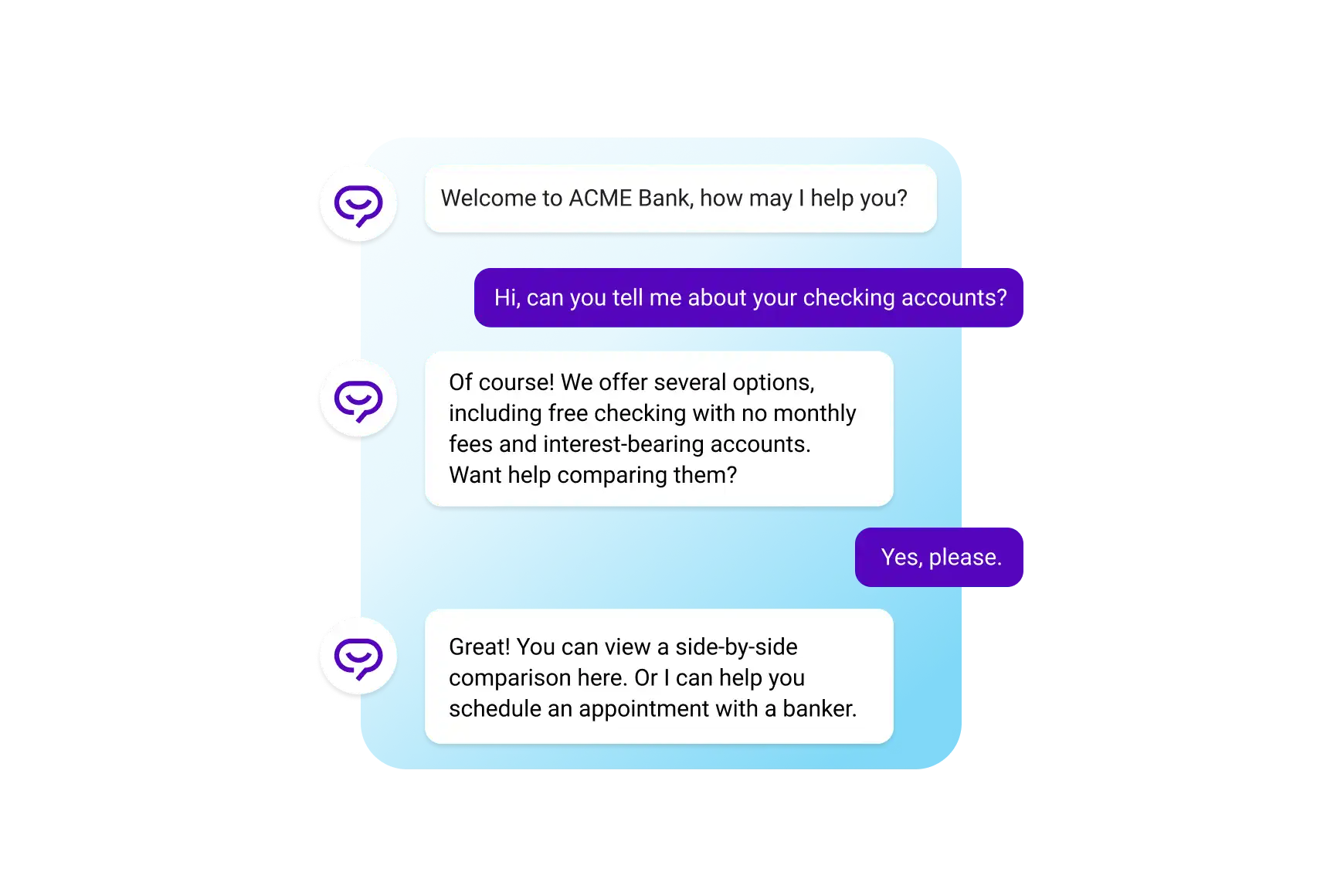

Omnichannel engagement that drives client satisfaction.

Engage clients seamlessly across voice, chat, SMS, and digital channels, with AI-powered automation for quick issue resolution. Intelligent routing ensures customers reach the right banker or advisor, while AI-powered outbound engagement proactively connects with customers, helping banks drive loyalty and retention.

Powering the future of financial services.

See how Talkdesk Financial Services Experience Cloud powered by CXA drives transformational efficiency in financial services while improving outcomes for clients and employees.

Out-of-the-box and custom integrations for banking.

Core banking

Digital banking

“With Financial Services Experience Cloud WaFd is primed to meet our clients’ expectations today through intelligent, connected, and secure interactions while having a foundation in place for tomorrow’s CX challenges.”

Dustin Hubbard, Chief Technology Officer at WaFd Bank, Pike Street Labs

certifications

The trusted choice for your contact center.

Related resources.

FAQs

Get answers to your questions about financial services contact center solutions.

AI-powered automation personalizes every client interaction by intelligently routing customers, offering self-service options, and proactively engaging them through voice, SMS, and digital channels. Banking customer experience platform features like Proactive Outbound Engagement send automated reminders and updates, while Talkdesk Copilot™ provides real-time guidance to agents, helping them deliver faster, more meaningful conversations.

AI-powered account servicing workflows allow customers to self-serve for common requests like account transfers, adding authorized users, resetting passwords, and travel notifications. For complex issues, Talkdesk Banking Workspace™ gives agents a unified view of customer data—ensuring personalized and efficient resolutions.

Yes. AI automates loan inquiries, follow-ups, and payoff quotes through self-service workflows, reducing processing time and agent workload. Omnichannel payment reminders send automated notifications about upcoming payments, while collections enable real-time digital payment processing to reduce charge-offs.

The Talkdesk end-to-end platform, with pre-built core banking, digital banking and other integrations, prevents companies from having to build these integrations themselves or maintain multiple point solutions. In addition, by automating repetitive tasks and enabling self-service, AI-powered banking solutions reduce live agent interactions, improve efficiency, and lower outsourcing costs.

AI-powered security features like Talkdesk Shield™ help prevent fraud and unauthorized access by authenticating users, monitoring interactions, and ensuring compliance with PCI DSS, GDPR, SOC 2, and ISO 27001. Automated monitoring and reporting also help reduce regulatory risks.

Talkdesk is designed for rapid deployment, with pre-built integrations for core banking systems, CRMs, and digital banking platforms. Talkdesk Connections™ allow teams to quickly connect third-party systems, reducing implementation time from months to weeks.

AI optimizes banking call center agent workflows by automating pre-, during-, and post-call tasks, reducing manual work and shortening handle times. Talkdesk Copilot™ provides real-time transcription and next-best-action recommendations, while Talkdesk AI Trainer™ allows non-technical teams to refine AI models for continuous improvement.

Talkdesk Digital Engagement™ ensures customers can connect on their preferred channel, including voice, chat, SMS, and digital platforms, while Orchestration & Routing with Talkdesk Studio™ creates consistent experiences across touchpoints.

Real-time business intelligence and analytics provide insights into call performance, agent productivity, and customer satisfaction. Features like Talkdesk Business Intelligence™, Real-time Dashboards, and Talkdesk Feedback™ help banks track performance, optimize workflows, and measure customer experience in banking.

AI-driven compliance tools automate security monitoring, fraud detection, and regulatory reporting. Talkdesk Shield™ protects against fraud and unauthorized access, while Talkdesk Quality Management™ and QM Assist™ provide automated interaction scoring, sentiment analysis, and searchable transcripts to ensure regulatory adherence.